Turnaround Techniques for Distressed Mortgage…

Distressed mortgage assets—loans in severe delinquency, foreclosure, or…

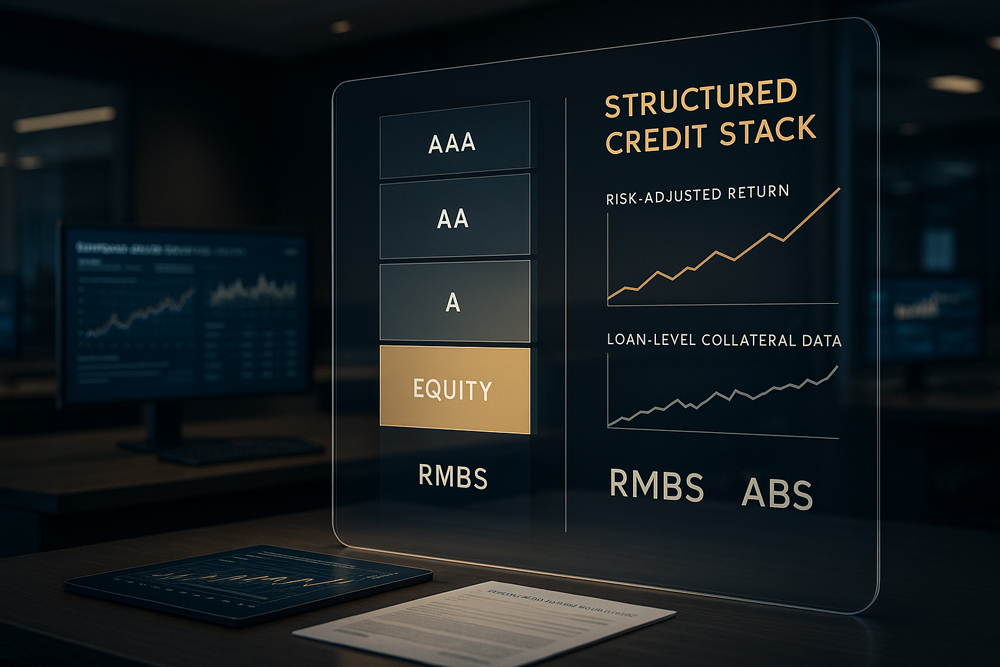

Procyon Capital Management is a structured credit platform built to unlock value across the securitized consumer debt and residential mortgage ecosystem. We utilize proprietary AI-driven analytics, direct origination partnerships, and institutional-grade investment governance to deliver superior risk-adjusted returns.

Who We Are

Procyon Capital Management is an independent investment firm focused on unlocking value in securitized credit – primarily across residential real estate and consumer lending.

Procyon Capital Management is a leading structured credit and real estate investor. We manage a diversified portfolio focused on mortgage-related assets, including RMBS, CMBS, MSRs, whole loans, and structured real estate debt.

Distressed mortgage assets—loans in severe delinquency, foreclosure, or…

Regulatory compliance sits at the heart of sustainable…

Mortgage-backed securities (MBS) offer investors access to diversified…

As the mortgage markets grow in complexity and…

Sign up to our newsletter

Keep up with the latest Procyon news and insights