Mortgage-backed securities (MBS) offer investors access to diversified pools of mortgage loans, but they also carry unique risks—interest-rate movements, credit losses, prepayment volatility, and liquidity constraints. Effective risk mitigation is essential to protect portfolio value and stabilize returns. Below, we explore the most impactful strategies that institutional and high-net-worth investors use to manage and hedge the distinct risks inherent in MBS investments.

1. Interest-Rate Hedging with Derivatives

What It Is:

Using interest-rate swaps, futures, and options to neutralize the sensitivity of an MBS portfolio to changes in Treasury yields.

- Swaps & Swaptions: Enter into pay-fixed, receive-floating swaps to offset negative duration and convexity effects. Swaptions give optionality—right, but not obligation—to enter a swap at a pre-specified rate.

- Treasury Futures: Short futures on U.S. Treasuries (e.g., 10-year notes) to hedge parallel shifts in the yield curve quickly and cost-effectively.

- Options on Futures: Enhance convexity protection by buying calls or puts on Treasury futures to guard against large rate moves.

Why It Matters:

MBS typically exhibit negative convexity: prices fall more when rates rise than they gain when rates fall. Derivative overlays help smooth portfolio P&L and maintain target duration even as underlying loan prepayments fluctuate.

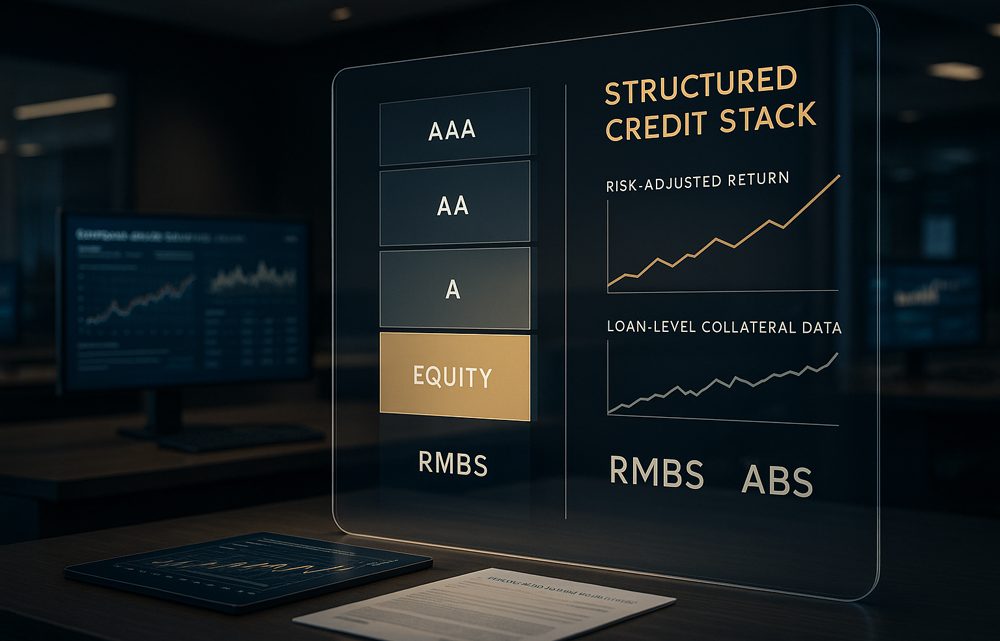

2. Credit Enhancement Structures

What It Is:

Structural tools built into securitizations to absorb first-loss credit events and protect senior tranches.

- Over-Collateralization (OC): Issuing more mortgage principal than par to create a buffer—excess collateral covers initial losses.

- Reserve or Cash-Collateral Accounts: Cash set aside from issuance proceeds to cover delinquencies or shortfalls.

- Third-Party Guarantees: Monoline insurers or agencies (e.g., Ginnie Mae guarantees) backstop payments on senior tranches.

Why It Matters:

These enhancements reduce expected credit losses for senior MBS holders and often improve credit ratings—lowering funding costs and widening investor demand.

3. Dynamic Prepayment Risk Management

What It Is:

Adjusting portfolio positioning and hedges in response to evolving prepayment forecasts driven by rate changes and borrower behavior.

- Scenario-Based Hedging: Stress-test cash flows under multiple PSA speeds (e.g., 50%, 150%) and recalibrate swap notional or futures positions accordingly.

- Barbell Structures: Combine short- and long-duration MBS tranches to offset prepayment convexity at different rate levels.

- Embedded Option Valuation Models: Use option-adjusted spread (OAS) analysis to price and hedge prepayment optionality precisely.

Why It Matters:

Prepayment spikes can erode expected yield and reinvestment opportunities; a nimble hedging framework ensures exposure remains aligned with rate outlook.

4. Portfolio Diversification & Tranche Selection

What It Is:

Allocating across multiple issuance types, vintages, servicers, and credit tiers.

- Issuer and Servicer Diversification: Spread exposure among different GSE pools (Fannie Mae, Freddie Mac) and private-label issuers to avoid single-point servicing or underwriting concentration.

- Vintage Staggering: Combine newly issued and seasoned pools—seasoned MBS often exhibit more stable prepayment and credit profiles.

- Credit-Tier Layering: Mix prime, Alt-A, and select non-agency tranches, balancing yield pickup against incremental credit risk.

Why It Matters:

Diversification reduces idiosyncratic shocks—from servicer disruptions to regional housing downturns—and smooths overall portfolio performance.

5. Stress Testing & Scenario Analysis

What It Is:

Running forward-looking simulations to quantify potential losses under severe economic, rate, and housing scenarios.

- Rate Shock Scenarios: Analyze parallel and non-parallel yield-curve shifts (e.g., +200 bps flattening, +300 bps steepener).

- Housing Price Shocks: Model home-price declines of 10–30% to assess LTV drift and loss severity on non-agency pools.

- Credit Stress Events: Simulate recessionary unemployment spikes to project delinquency and default trajectories.

Why It Matters:

Stress tests reveal hidden vulnerabilities, inform cushion sizing (OC levels, reserves), and guide tactical de-risking or capital withholding.

6. Liquidity Management & Exit Planning

What It Is:

Ensuring MBS holdings can be monetized under tight market conditions without excessive bid-ask slippage.

- Hold-to-Maturity vs. Trading Book: Segment assets by intended holding period and liquidity profile; keep highly liquid, agency MBS in the trading bucket.

- Commercial Repo Lines: Establish secured financing agreements to monetize MBS against Treasury collateral during funding stress.

- Staggered Trade Tickets: Break up large blocks into smaller trade executions to minimize market impact.

Why It Matters:

During episodes of market stress—like the 2008 fire-sale of private-label MBS—liquidity premia can widen dramatically. Proactive liquidity plans protect against forced selling at depressed levels.

7. Governance & Monitoring Framework

What It Is:

A formalized process for ongoing review of risk metrics, hedge performance, and counterparty exposures.

- Risk Committees: Monthly or weekly review of hedge effectiveness, model performance, and credit quality trends.

- Counterparty Limits: Caps on exposure to any single swap dealer, clearinghouse, or repo counterparty.

- Model-Risk Oversight: Independent validation of prepayment, OAS, and valuation models, with back-testing against realized outcomes.

Why It Matters:

Strong governance ensures strategies remain effective as market conditions evolve and prevents undue concentration or model breakdowns.

Conclusion

Mitigating the complex risks of mortgage-backed securities demands a multi-layered approach: derivative overlays to manage interest-rate and convexity risk; structural credit enhancements to shield senior tranches; dynamic prepayment hedges; rigorous stress testing; and robust liquidity and governance frameworks. By combining these strategies within an integrated risk-management program, investors can capture the attractive yields of MBS while maintaining confidence in portfolio resilience.

Ready to fortify your MBS portfolio? Our advisory team specializes in designing bespoke hedging programs, credit-enhancement analyses, and stress-testing platforms tailored to diverse mortgage-asset mandates. Reach out today to discuss how we can help you navigate and mitigate mortgage-backed risks effectively.